MAHDA

Trust AI in trading!

Hunting unique investment opportunities by artificial intelligence considering hundreds of variables using deep learning and machine learning algorithms and taking into account different risk measurements makes MAHDA fund a powerful fully automated hedge fund.

Contact us

Pipeline

The MAHDA crypto pipeline is implemented in four steps. Each of these steps uses its own unique technology.

Order Generation

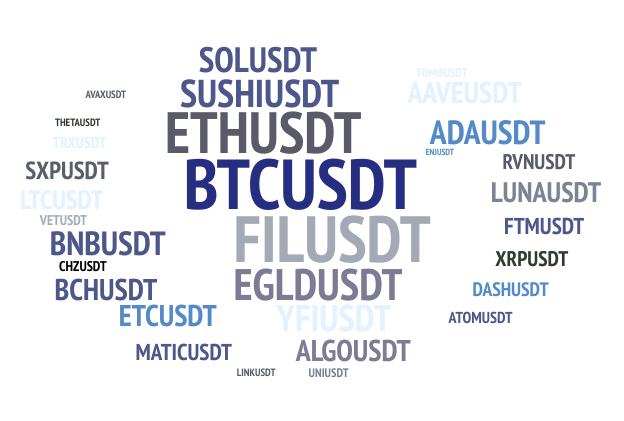

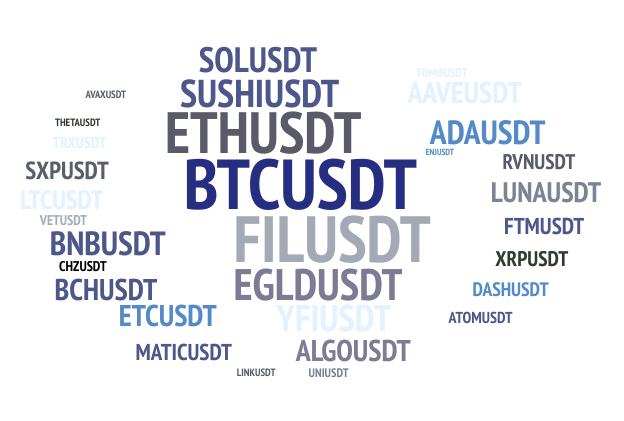

Coins selection

First, 65 coins are given to the coin selection model in terms of the largest market size. Every 12 hours, the model selects suitable candidate coins for trading in the next 12 hours based on their recent movement/trend and volatility.

Open a position

To generate an order on the selected coins, the AI model checks the past state of the coin and the market situation. If the coin momentum triggers the threshold of the risk to return, the order is sent to the order opening section.

Every 1 hour

, the model checks more than 500 parameters on the selected

coins and decides whether to enter the market or not. According

to the state of the coin, the appropriate entry point to open

the position is determined.

Order Generation Steps

1. AI Technologies

2. Data Acquisition

3. Data Cleaning Tool

4. MAHDA ML tool

5. Backtest Technology

Since our strategies are completely systematic, we have developed most of our investment technologies in-house. This makes it possible to control the quality of execution and meet the requirements of our trading algorithms.These internal automated tools help our quantitative research team quickly and efficiently identify new sources of trend in large datasets.

The first step in deploying a new quantitative investment strategy is data acquisition. To support our AI model to find a good price level to generate orders, we use big data, browsing multiple datasets from different areas. We deliver 500 factors to the AI model as input.

Since we are using different sources of data, we may end up with unstructured format that is not suitable for the AI models, so data needs to be cleaned. Our Data team has implemented various automated tools to support big data that need to be cleaned up and checked for potential errors.

Once the data is cleaned, our AI model begins to explore the data. Carbon has six sub-models including two deep neural networks and four classic machine learning algorithms. Carbon creates an ensemble learning framework in order to improve the accuracy and enhance the return. As a result, Carbon generates Buy, Sell, and Hold signals on each coin.

After discovering new sources of alpha signal, our researchers conduct backtests that span long historical data to increase the likelihood of finding reliable signals.Our quantitative backtest model requires advanced algorithms and sufficient processing power to complete their tests as quickly as possible.

1. AI Technologies

Since our strategies are completely systematic, we have developed most of our investment technologies in-house. This makes it possible to control the quality of execution and meet the requirements of our trading algorithms.These internal automated tools help our quantitative research team quickly and efficiently identify new sources of trend in large datasets.

2. Data Acquisition

2. Data Acquisition

The first step in deploying a new quantitative investment strategy is data acquisition. To support our AI model to find a good price level to generate orders, we use big data, browsing multiple datasets from different areas. We deliver 500 factors to the AI model as input.

3. Data Cleaning

Since we are using different sources of data, we may end up with unstructured format that is not suitable for the AI models, so data needs to be cleaned. Our Data team has implemented various automated tools to support big data that need to be cleaned up and checked for potential errors.

4. Carbon: MAHDA ML tool

4. Carbon: MAHDA ML tool

Once the data is cleaned, our AI model begins to explore the data. Carbon has six sub-models including two deep neural networks and four classic machine learning algorithms. Carbon creates an ensemble learning framework in order to improve the accuracy and enhance the return. As a result, Carbon generates Buy, Sell, and Hold signals on each coin.

5. Backtest Technology

After discovering new sources of alpha signal, our researchers conduct backtests that span long historical data to increase the likelihood of finding reliable signals.Our quantitative backtest model requires advanced algorithms and sufficient processing power to complete their tests as quickly as possible.

Bet Sizing

The size of the order comes from a model that allocates a predesigned risk function based on the investors preferences.

The share of each order from the available base asset is determined based on the coin's volatility in the market and the coin's trading volume in the last 12 hours.

The size of the order comes from a model that allocates a predesigned risk function based on the investors preferences.

The share of each order from the available base asset is determined based on the coin's volatility in the market and the coin's trading volume in the last 12 hours.

Order Execution

MAHDA has built the execution system according to its own needs. This system connects to the exchange through API and places orders. Currently, it works on Binance, Kocoin, but due to its infrastructure, it can easily be developed and connected to other exchanges. This system has the possibility of executing all the commands generated in the previous section, such as risk-free position, trailing, etc.something

Exit Strategy

Hard SL & TP

According to the history of the coin, the level of volatility of each coin and the maximum amount of acceptable risk, stop loss and take profit are determined.

Build Risk Free Position

If the take profit level is touched, 50% of the position will be closed and the stop loss will be moved to the entry point (breakeven).

Trailing Stop Loss

Our artificial intelligence model trails stop loss based on the trend of the coin and the market. In main trends, the trailing stop moves with the market and prevents early exit from the position.